Real estate investing is one of the consistent commodities amongst millionaires across the world! As someone who has spent the last 9 years investing heavily in real estate, I have not only grown my portfolio to a position where we now have over 100 doors, but I’ve been given the opportunity to speak across several platforms teaching people just like you exactly how this is done! Which is one of the reasons I got my real estate license! You’d be amazed to learn that the Real Estate Education Program in Ontario spends little to no time on how to spot, analyze, or calculate investment properties, CAP rates, or return on investment metrics. So now, part of my mission, is to be able to show you, that you too, can have success in real estate investing, if you are taught how to properly set this up from the start.

So, we are back to basics – where do I start and what does it cost?

Making sure you are partnered with a real estate agent who can guide you through the anticipated costs of real estate investment acquisition can give you a competitive edge above others is actually a key. I am not saying this because I am an agent, I am saying this because as a newbie investor, you are leaning on your agent to KNOW what it is that you are looking for, and how to assess the situation. …. but remember what I said earlier? This isn’t really taught in school. So unless you happen to stumble across an agent who’s taken the time to learn it, the likelihood that they just happen to understand, probably isn’t that high. A question I get regularly from clients who are interested in investing in real estate is “how do I begin and how much money do I need?”

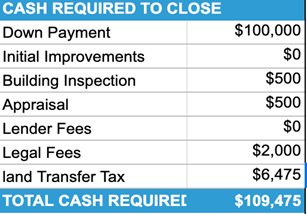

In Ontario, any residence that is purchased as an investment will typically require a 20% down payment. So, if you are looking at purchasing a 500,000 home, you will need a $100,000 down payment towards the purchase price.

There are a few other costs associated with purchasing a property that many individuals overlook when they are looking at purchasing that are important to keep in mind.

Land transfer tax: Land transfer tax is calculated based upon where in the province you are buying and the purchase price of the property. You can use this simple land transfer tax calculator to gain insights as to what you can expect your costs to be:

Real Estate Fees: In Ontario, real estate fees are typically incurred by the seller of the property however, there are a few exceptions to this. Make sure that you are working with an investment focused Realtor that can advise you what the expected associated realtor fees may include.

Appraisal and Inspection Fees: If you are purchasing a property and wanting to have an inspection done, the cost of this will vary depending on the area you are working in. I typically see these range anywhere from $500-$800 in the Simcoe County area.

For anyone who is purchasing a home through one of the big banks, the banks will almost always order an appraisal of the property to be done at your cost.

Renovation costs: If you are planning to purchase an investment property and complete renovations to it, make sure that you are calculating the appropriate renovation costs, as well as including any permitting fees that might be necessary.

Lawyers’ fees: When purchasing a residential investment property I will typically allocate $2,000 for lawyers’ fees. That cost will vary depending on the number of units you are purchasing and the complexity of the investment.

Many of the individuals I speak to are nervous to start investing. My advice for beginners is start small and make sure you’re not risking everything! Once you get a feel for how this goes and what to expect you can grow your portfolio from there. And don’t forget to make sure you are partnered with a real estate agent who understands the investment world! I can’t wait to hear from you!